Offshore Company Formation & Bank Accounts

WHO WE ARE

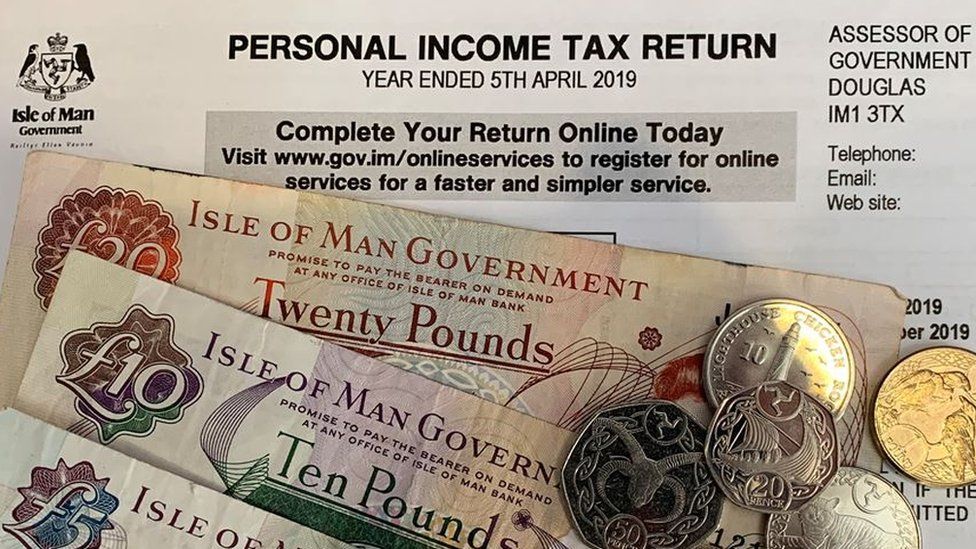

At Chesterfield, we’re passionate about giving our clients the kinds of financial/business opportunities they’ve always dreamed of in Cyprus, Isle of Man or British Virgin Islands. Our services span across four key businesses (offshore, contracting, property, and crewing) which means that we offer the kind of unsurpassed excellence and flexibility you would never encounter anywhere else.

We want our clients to know just how important they are to us and so offer the highest quality service whilst striving to maintain the best quality products on the market while still maintaining a close professional relationship with each and every client, ensuring not only that we are completely in tune with their needs, but that they know they can trust us with every aspect of their business requirements. In today’s world, the personal touch is a feature that is fast becoming absent from business transactions.

OFFSHORE COMPANY FORMATION SERVICES

Over the years, we have been helping clients in need of international business consultancy. Our services include full registration and management for offshore companies, invoicing, banking, companies formation, contractor insurance, trust formation and administration, umbrella services, contracting, international payroll and Maritime Payroll Services with a focus on protection of privacy. You can rest assured that your information is safe with us because confidentiality is one thing which always matters most!

The current climate in which we live is one of globalism and entrepreneurship. Entrepreneurship has never been more popular than it currently stands, with many people aspiring to set up offshore companies for the economic benefits they offer or just because their interests lead them that way.

The protection of your personal data should be an integral part when looking into starting any type business nowadays; after all our lives are increasingly digitalized – so too much information about you can put yourself at risk!